39 coupon rate and ytm

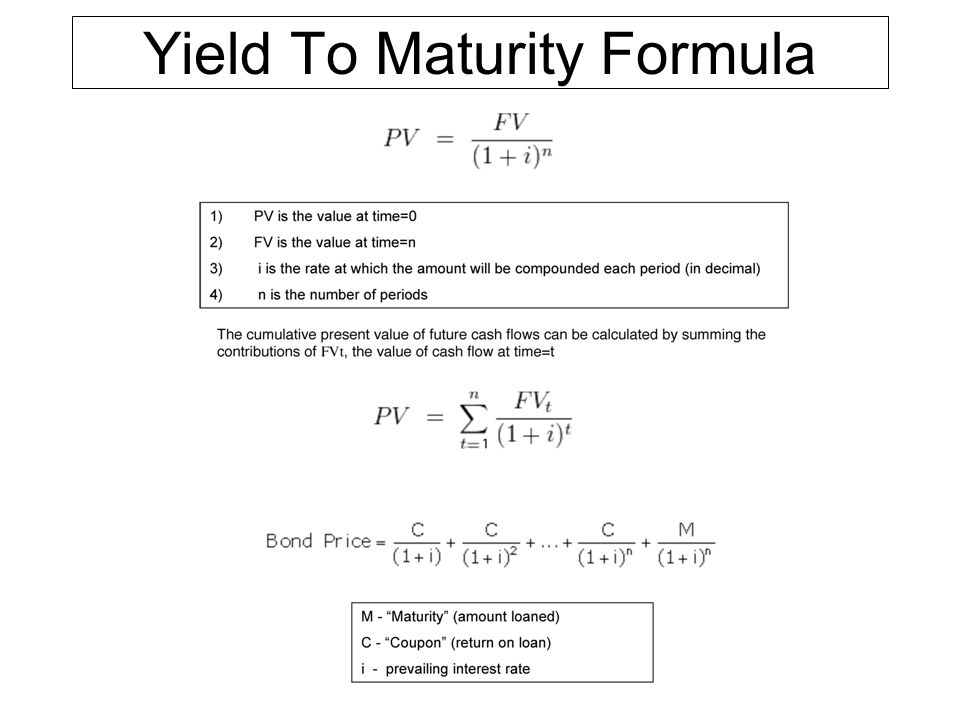

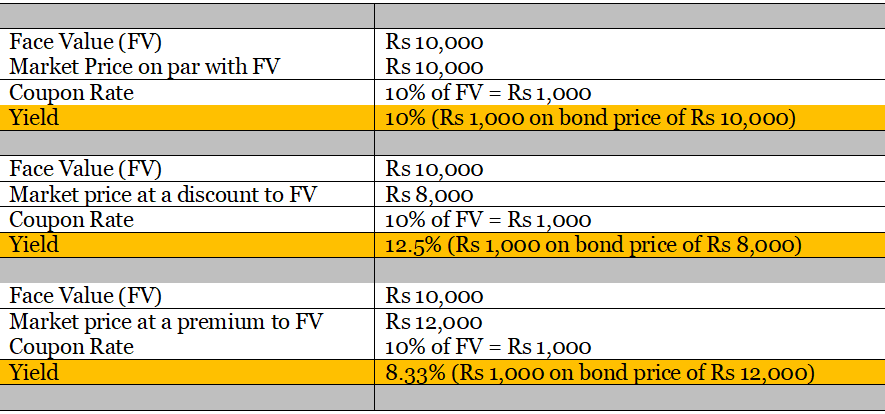

Preferred Stock - YTC Calculator Calculate Yield to Call : Click the Year to select the Call Date, enter coupon call and latest price then Calculate What is Bond - Meaning, Types & YTM Calculation Process - Scripbox The issuer also pays interest on the money borrowed ( coupon payment) throughout the tenure of the loan period. The bond's face value is mostly INR 1,000. The issuer will fix the coupon rate. However, the market price or issue price will depend on the credit quality of the borrower, holding period until maturity, and the coupon rate.

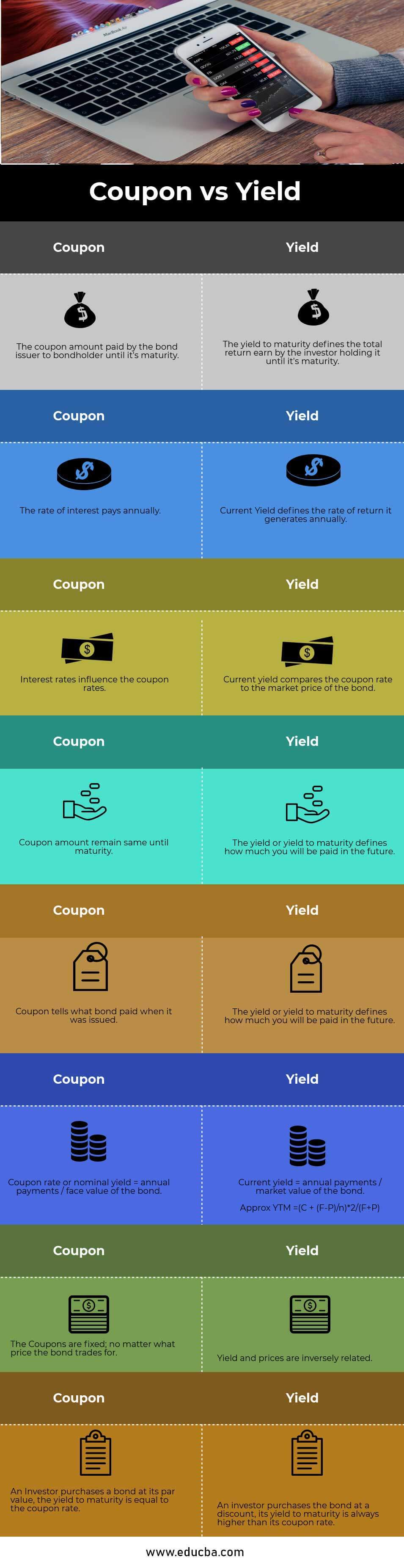

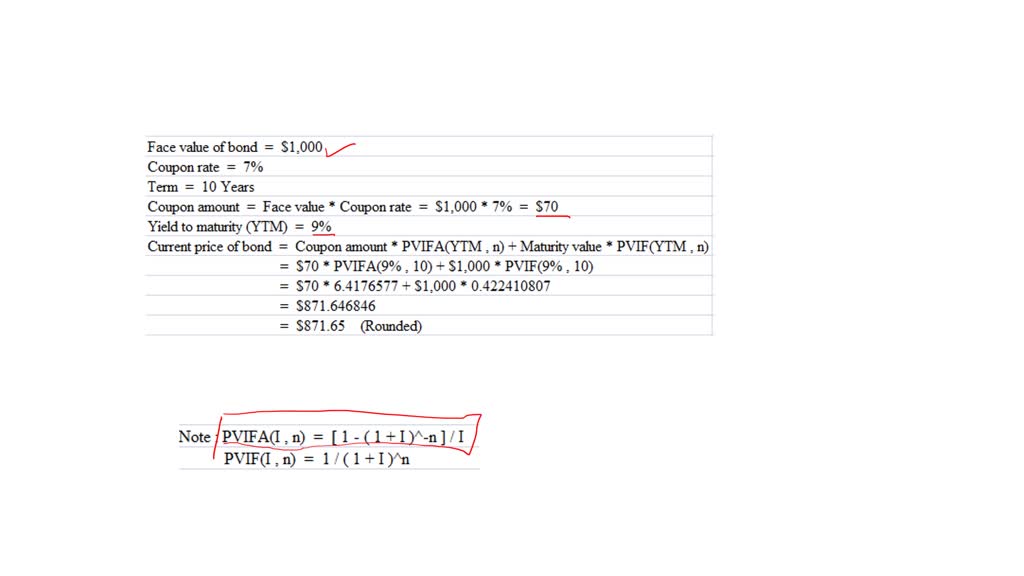

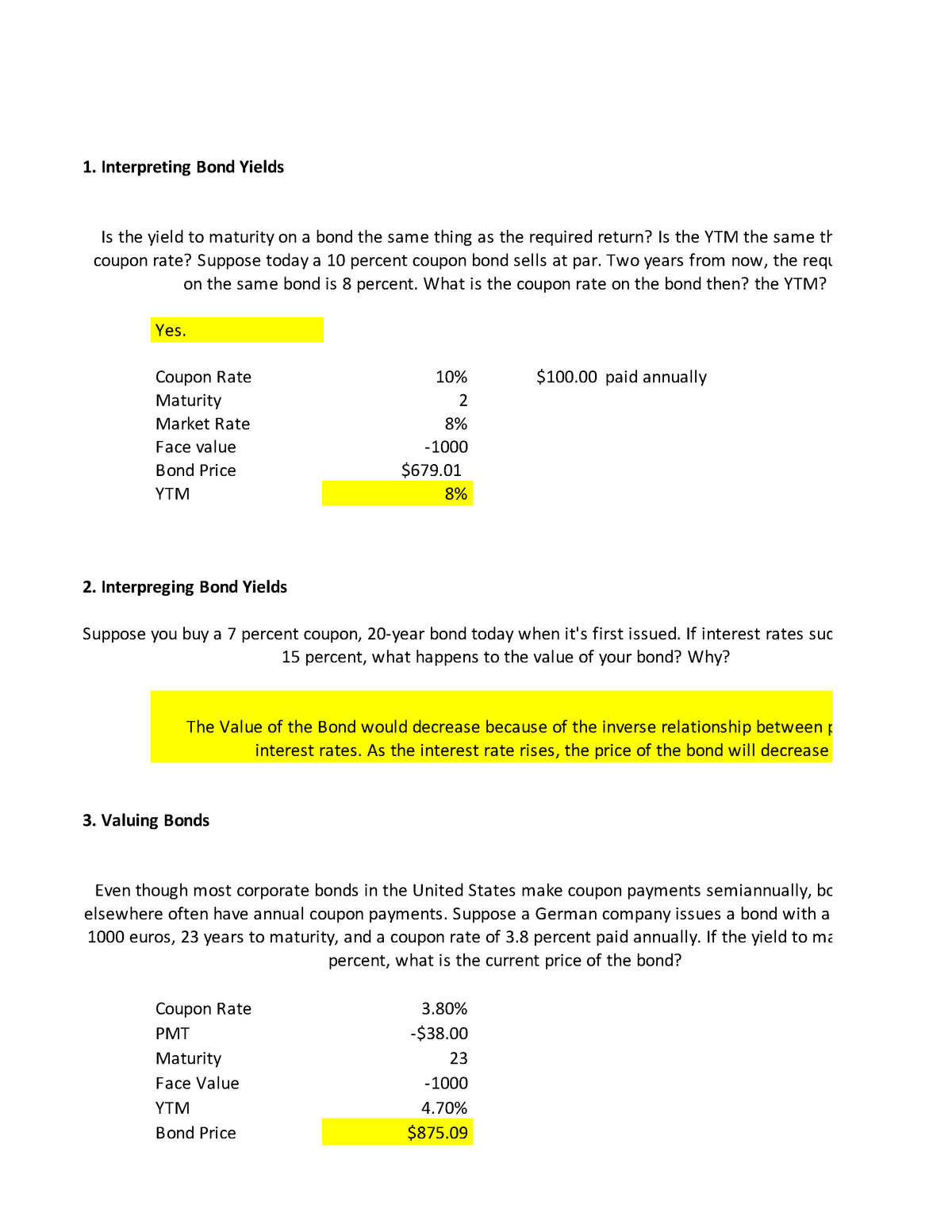

Difference Between Coupon Rate and Required Return Coupon Rate is the periodical price that the buyer receives until the bond matures. Required Return is the amount paid for the investor to own the risks. The coupon rate is calculated using the formula Coupon rate = ( Total annual payment/par value of bond) * 100. Required Return is calculated by using the beta value.

Coupon rate and ytm

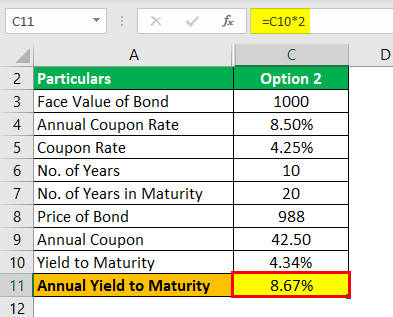

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 3 days ago, on 7 Oct 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities. Indiabulls Housing Finance Ltd 9.0% bond yield, coupon rate ... - INDmoney Indiabulls Housing Finance Limited 10.1%. Last traded on 16 Mar, 2015. Coupon Rate. 10.1%. Face Value. ₹1 Lac. Time till maturity. 4 mo. Credit Rating. Yield to Maturity Calculator | YTM | InvestingAnswers coupon rate number of years to maturity frequency of payments, and current price of the bond. How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and matures in 5 years. You would enter: "1,000" as the face value "8" as the annual coupon rate

Coupon rate and ytm. EOF Yield to Maturity vs. Holding Period Return - Investopedia The YTM, often stated as an annual percentage rate (APR), assumes that all coupon and principal payments are made on time. Many computations also account for reinvested dividends, but this is not a... Germany Government Bonds - Yields Curve The Germany 10Y Government Bond has a 2.194% yield. 10 Years vs 2 Years bond spread is 33.4 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 1.25% (last modification in September 2022). The Germany credit rating is AAA, according to Standard & Poor's agency. Yield to Call Calculator | Calculating YTC | InvestingAnswers coupon rate number of years to the call date frequency of payments call premium (if any) current price of the bond Calculating Yield to Call Example For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator, enter:

ICE BofA US High Yield Index Effective Yield - St. Louis Fed Each security must have greater than 1 year of remaining maturity, a fixed coupon schedule, and a minimum amount outstanding of $100 million. Original issue zero coupon bonds, "global" securities (debt issued simultaneously in the eurobond and US domestic bond markets), 144a securities and pay-in-kind securities, including toggle notes, qualify ... NSE - National Stock Exchange of India Ltd. Note:- Trade Date and Settlement Information is available on our beta.nseindia.com site.beta.nseindia.com site. YTM - BrainMass 1) Bond prices and yields Assume that the Financial Management Corporations $ 1,000- par- value bond had a 5.700% coupon, matured on May 15, 2017, had a current price quote of 97.708, and had a yield to maturity ( YTM) of 6.034%. Given this information, answer the following questions. a. What was the dollar price of the bond? b. United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.888% yield. 10 Years vs 2 Years bond spread is -42.6 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency.

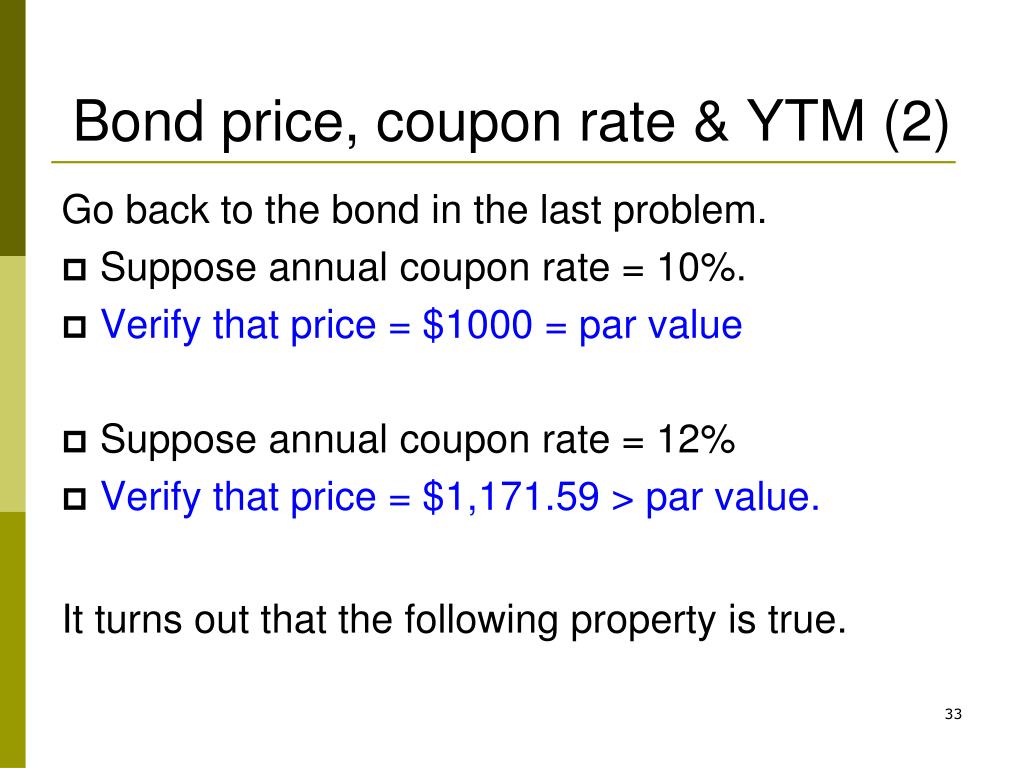

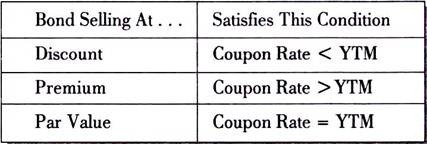

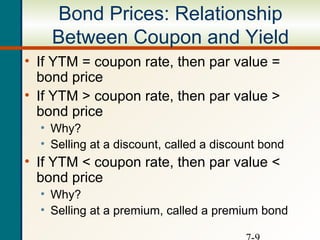

Bonds- YTM, coupon rate, interest rate risk - BrainMass Is YTM the same thing as the coupon rate? Suppose today a 10 percent coupon bond sells at par. Two years from now, the required return on the same bond is 8 percent. What is ... Solution Summary Calculates YTM, coupon rate and interprets the interest rate risk of lower-coupon bonds. $2.49 Add Solution to Cart Difference Between Bond Yield and Yield to Maturity To be sold at a premium, the yield to maturity of a bond should be less than its coupon rate, and to sell the bond at a discount, the yield to maturity should be more than its's coupon rate. Similarly, if the YTM of a bond equals the coupon rate, the bond sells at standard. There are three variants in YTM, depending upon the type of bond. Yield to Maturity Calculator | YTM | InvestingAnswers coupon rate number of years to maturity frequency of payments, and current price of the bond. How to Calculate Yield to Maturity For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and matures in 5 years. You would enter: "1,000" as the face value "8" as the annual coupon rate Indiabulls Housing Finance Ltd 9.0% bond yield, coupon rate ... - INDmoney Indiabulls Housing Finance Limited 10.1%. Last traded on 16 Mar, 2015. Coupon Rate. 10.1%. Face Value. ₹1 Lac. Time till maturity. 4 mo. Credit Rating.

US Treasury Zero-Coupon Yield Curve - NASDAQ Refreshed 3 days ago, on 7 Oct 2022 ; Frequency daily; Description These yield curves are an off-the-run Treasury yield curve based on a large set of outstanding Treasury notes and bonds, and are based on a continuous compounding convention. Values are daily estimates of the yield curve from 1961 for the entire maturity range spanned by outstanding Treasury securities.

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "39 coupon rate and ytm"