43 find the face value of the zero coupon bond

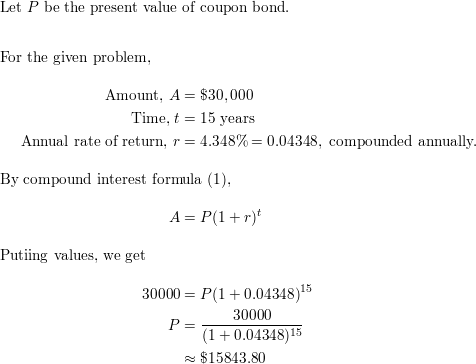

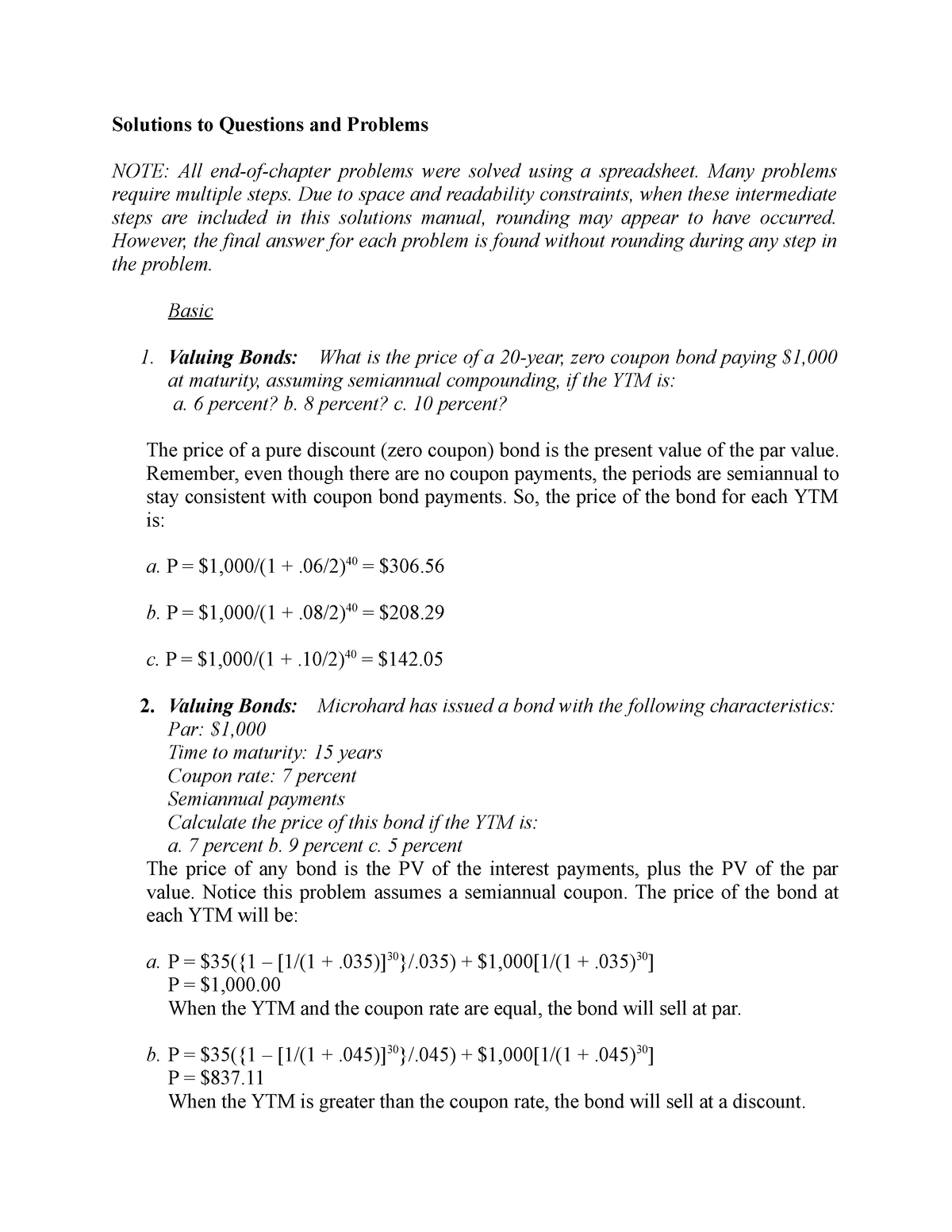

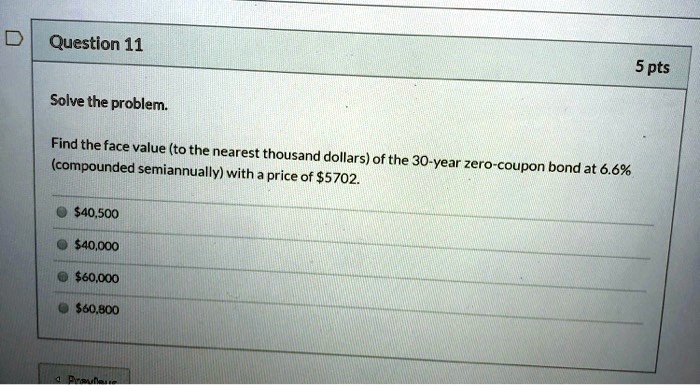

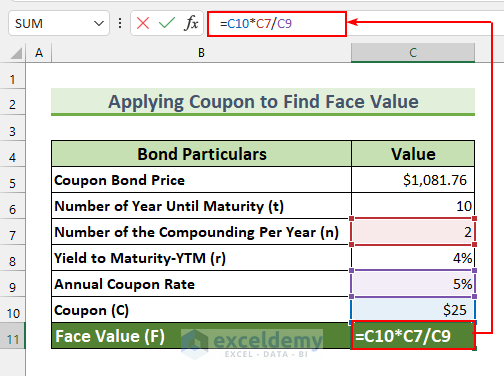

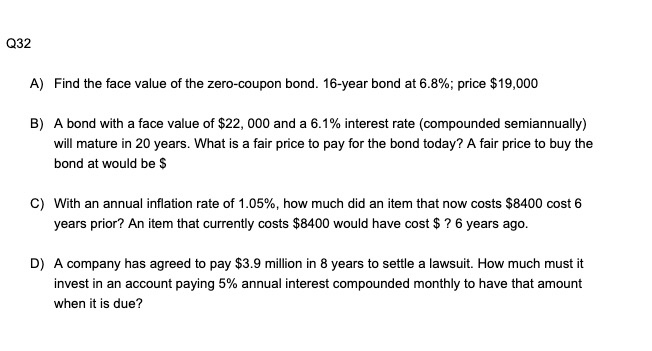

F = the face value, or the full value of the bond. P = the price the ... The coupon payment is $100 ( ). The algorithm behind this bond price calculator is based on the formula explained in the following rows: Where: F = Face/par value. c = Coupon rate. n = Coupon rate compounding freq. (n = 1 for Annually, 2 for Semiannually, 4 for Quarterly or 12 for Monthly) r = Market interest rate. t = No. of years until maturity. Solved Find the face value of the zero-coupon bond. 12-year - Chegg Find the face value of the zero-coupon bond. 12-year bond at 3.9% (compounded semiannually); price $14,000 The face value will be $ (Round to the nearest dollar as needed.)

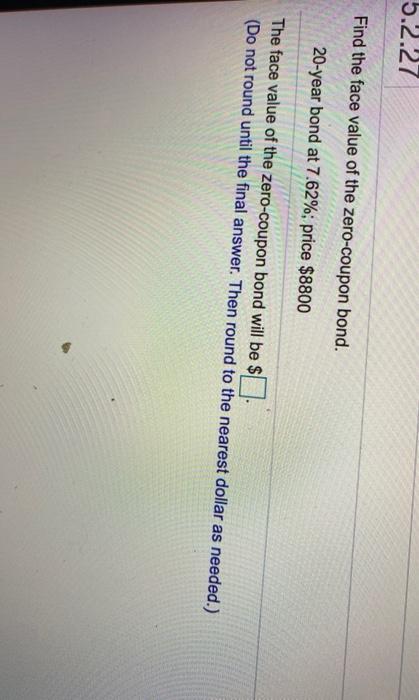

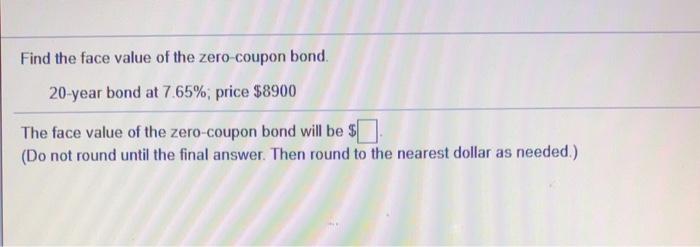

Solved Find the face value of the zero-coupon bond. | Chegg.com Question: Find the face value of the zero-coupon bond. 20-year bond at 5.95 %; price $9050 The face value of the zero-coupon bond will be $ ____. (Round to the nearest dollar as needed.) This problem has been solved! See the answer

Find the face value of the zero coupon bond

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ... A zero-coupon bond with face value $\$1,000$ and maturity of | Quizlet A newly issued 20-year maturity, zero-coupon bond is issued with a yield to maturity of 8% and face value $1,000. Find the imputed interest income in the first, second, and last year of the bond's life. Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

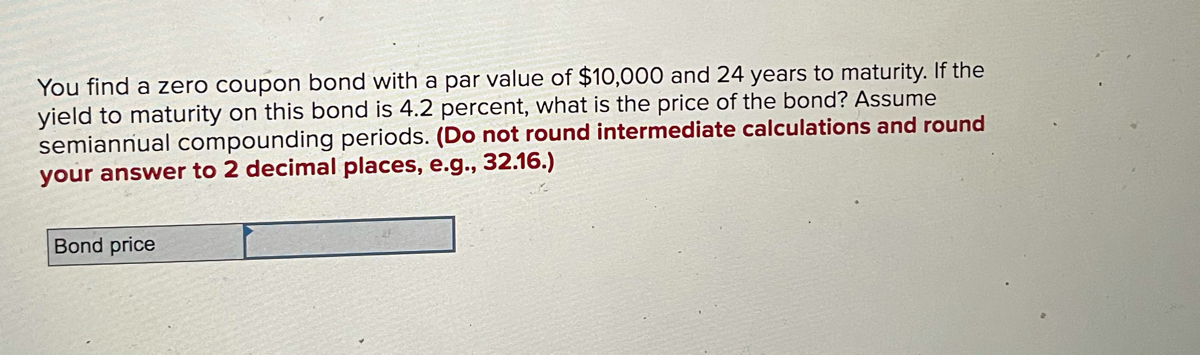

Find the face value of the zero coupon bond. Zero Coupon Bond Value Calculator - buyupside.com Compute the value (price) of a zero coupon bond. Zero Coupon Bond Value Calculator. Face Value ($): Yield (%): Years to Maturity: Value. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2. How Do Zero Coupon Bonds Work? - SmartAsset What Is a Zero Coupon Bond? A zero coupon bond is a type of bond that trades at a deep discount and doesn't pay interest. While some bonds start out as zero coupon bonds, others are can get transformed into them if a financial institution removes their coupons. When the bond reaches maturity, you'll get the par value (or face value) of the ... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding What Is a Zero-Coupon Bond? | The Motley Fool To find the current price of the bond, you'd follow the formula: Price of Zero-Coupon Bond = Face Value / (1+ interest rate) ^ time to maturity Price of Zero-Coupon Bond = $10,000 / (1.05) ^ 10 =...

Answered: Find the face value of the zero coupon… | bartleby Solution for Find the face value of the zero coupon bond 20 year bond at 5.67% price $9400 Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face ... Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Price of Zero Coupon Bond calculated annually Price of Zero Coupon Bond calculated semi-annually In both the formulas: Face value = Future value or maturity value of the bond r = Required rate of return or interest rate n = Number of years until maturity How to Calculate a Zero Coupon Bond Price | Double Entry ... Jul 16, 2019 · Using the example above, if the issue was a 10 year zero coupon bond, then the price at issue would be given as follows: n = 10 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 10%) 10 Zero coupon bond price = 508.35 (rounded to 508)

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ... Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity How Does the IRS Tax... Everything You Need to Know About Bonds | PIMCO In the market, bond prices are quoted as a percent of the bond’s face value. The easiest way to understand bond prices is to add a zero to the price quoted in the market. For example, if a bond is quoted at 99 in the market, the price is $990 for every $1,000 of face value and the bond is said to be trading at a discount. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. $1,000,000 / (1+0.03)20 = $553,675.75 Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions:

Zero Coupon Bond: Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

Zero Coupon Bond - Zero Coupon Bond - GitBook A zero coupon bond is a bond that doesn't pay interest/coupon but instead pays one lump sum face value at maturity. Investors buy zero coupon bonds at a deep discount from their face value. A zero coupon bond generates gains from the difference between the purchase price and the face value while a coupon bond produces gains from the regular ...

Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators Zero coupon bonds are yet another interesting security in the fixed income world.

How to Calculate the Price of a Zero Coupon Bond Divide the face value of the bond to calculate the price to pay for the zero-coupon bond to achieve your desired rate of return. Zero-Coupon Bond Price Example For example, say you want to earn a 6 percent rate of return per year on a bond with a face value of $2,000 that will mature in two years. First, divide 6 percent by 100 to get 0.06.

What are Zero-Coupon Bonds? (Characteristics and Examples) Zero-Coupon Bond – Bondholder Return. The return to the investor of a zero-coupon bond is equal to the difference between the face value of the bond and its purchase price. In exchange for providing the capital in the first place and agreeing not to be paid interest, the purchase price for a zero-coupon is less than its face value.

How to Calculate Yield to Maturity of a Zero-Coupon Bond Sep 23, 2022 · Zero-Coupon Bond YTM Example . Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The ...

14.3 Accounting for Zero-Coupon Bonds - Financial Accounting If a bond is issued for $37,000 and the company eventually repays the face value of $40,000, the additional $3,000 is interest on the debt. That is the charge paid for the use of the money that was borrowed. The price reduction below face value can be so significant that zero-coupon bonds are sometimes referred to as deep discount bonds.

Glossary - Common Fidelity Terms - Fidelity the interest rate a bond's issuer promises to pay to the bondholder until maturity, or other redemption event, generally expressed as an annual percentage of the bond's face value; for example, a bond with a 10% coupon will pay $100 per $1000 of the bond's face value per year, subject to credit risk; when searching Fidelity's secondary market ...

What Is the Face Value of a Bond? - SmartAsset A bond's coupon rate is the rate at which it earns these returns, and payments are based on the face value. So if a bond holds a $1,000 face value with a 5% coupon rate, then that would leave you with $50 in returns annually. This is in addition to the issuer paying you back the bond's face value on its maturity date.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Questions and Answers | Homework.Study.com View Answer. Compute the yield for a $1000 face value zero coupon bond that sells currently for $280 and matures in 20 years. View Answer. Compute the issue price of each of the following bonds. a. $10,000,000 face value, zero-coupon bonds due in 20 years, priced on the market to yield 8% compounded semiannually. b.

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value of Total Holding = 100 × $553.17 = $55,317 Expected accrued income = Value at the end of a period − Value at the start of a period = $55,317 − $50,000 = $5,317

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

How to Calculate the Price of Coupon Bond? - WallStreetMojo = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F , 6% would be r , and t would be 5 years. After solving the equation, the original price or value would be $74.73.

A zero-coupon bond with face value $\$1,000$ and maturity of | Quizlet A newly issued 20-year maturity, zero-coupon bond is issued with a yield to maturity of 8% and face value $1,000. Find the imputed interest income in the first, second, and last year of the bond's life.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ...

Post a Comment for "43 find the face value of the zero coupon bond"