40 how to calculate zero coupon bond price

Assignment Essays - Best Custom Writing Services Calculate the price. Type of paper. Academic level. Deadline. Pages (275 words) ... The further the deadline or the higher the number of pages you order, the lower the price per page! We don't juggle when it comes to pricing! Unlimited Revisions. Revisions are made for you at no charge. Make a revision and communicate with your writer exactly ... Join LiveJournal Password requirements: 6 to 30 characters long; ASCII characters only (characters found on a standard US keyboard); must contain at least 4 different symbols;

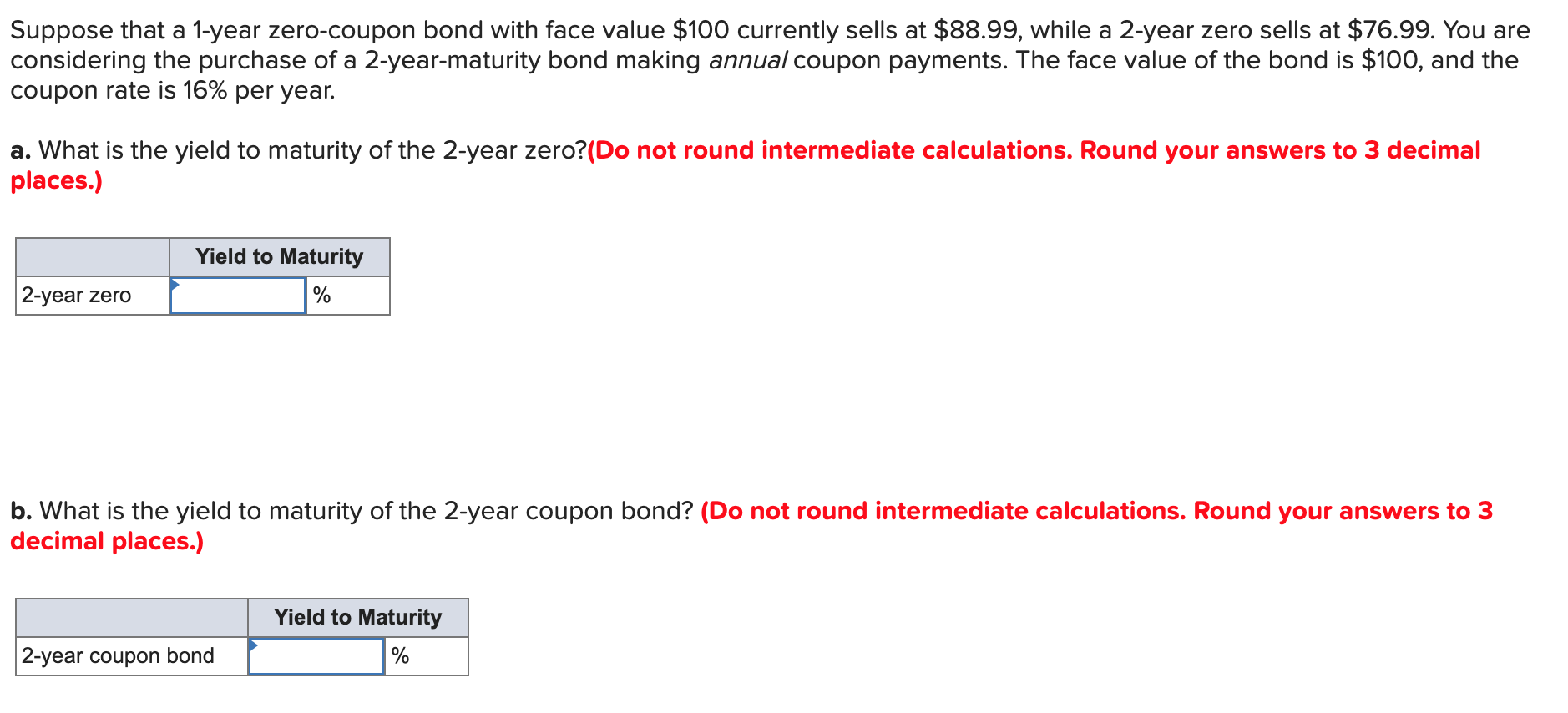

How to Calculate Bond Value: 6 Steps (with Pictures) - wikiHow Apr 19, 2021 · Many investors calculate the present value of a bond. The present value... A bond is a debt security that pays a fixed amount of interest until maturity. When a bond matures, the principal amount of the bond is returned to the bondholder. ... Assume that a bond has a face value of $1,000 and a coupon rate of 6%. The annual interest is $60 ...

How to calculate zero coupon bond price

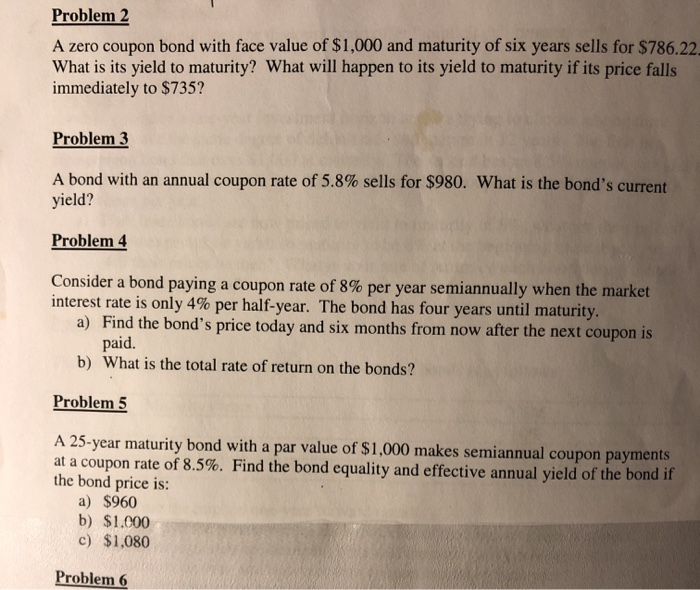

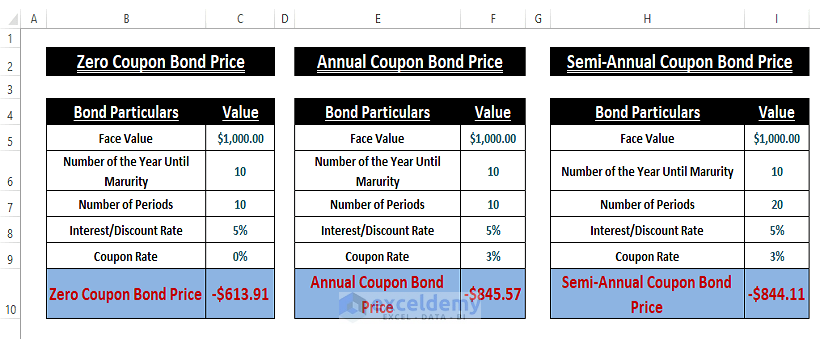

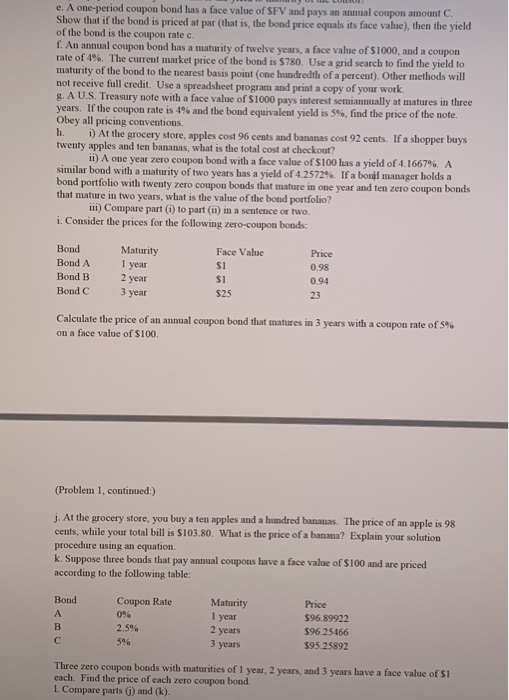

Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel; Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get ...

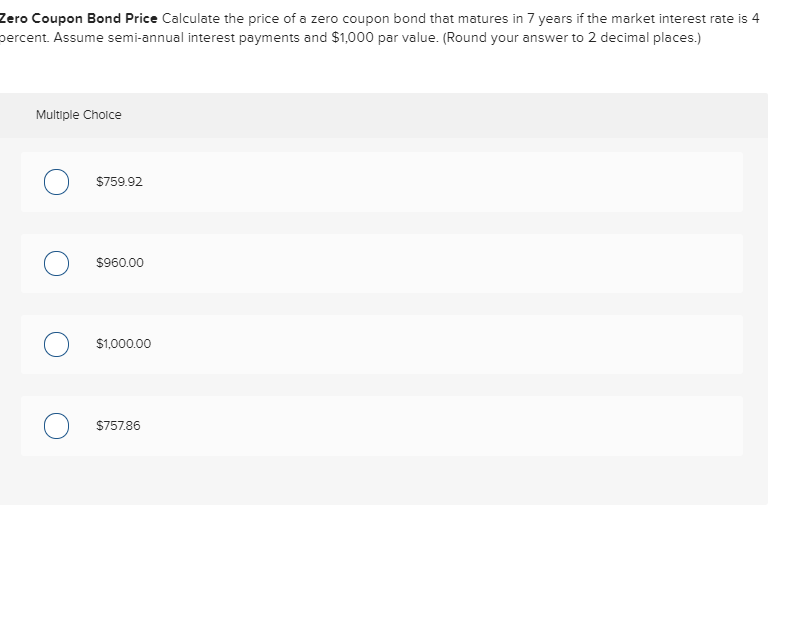

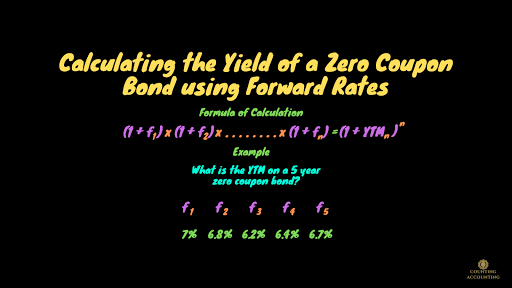

How to calculate zero coupon bond price. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Coupon Bond Formula | How to Calculate the Price of Coupon Bond? = $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · In addition, the discount rate used to calculate the bond's price increases. For these two reasons, the bond's price falls. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Fixed Income. Zero-Coupon Bond - Definition, How It Works, Formula Jan 28, 2022 · Therefore, a zero-coupon bond must trade at a discount because the issuer must offer a return to the investor for purchasing the bond. Pricing Zero-Coupon Bonds. To calculate the price of a zero-coupon bond, use the following formula: Where: Face value is the future value (maturity value) of the bond; r is the required rate of return or ...

How to calculate bond price in Excel? - ExtendOffice Calculate price of a zero coupon bond in Excel; Calculate price of an annual coupon bond in Excel; Calculate price of a semi-annual coupon bond in Excel; Calculate price of a zero coupon bond in Excel. For example there is 10-years bond, its face value is $1000, and the interest rate is 5.00%. Before the maturity date, the bondholder cannot get ... Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years. Bond: Financial Meaning With Examples and How They Are Priced Jul 01, 2022 · Bond: A bond is a fixed income investment in which an investor loans money to an entity (typically corporate or governmental) which borrows the funds for a defined period of time at a variable or ...

/GettyImages-983195940-6d4c5099c3314718a5ba16c33205d071.jpg)

Post a Comment for "40 how to calculate zero coupon bond price"