40 what is the duration of a zero coupon bond

Solved What is the approximate modified duration of a | Chegg.com What is the approximate modified duration of a 15-year zero-coupon bond with a par value of $1000 and a yield of 7.1%? B. 14 C. 12 D. 13 Zero-Coupon Bond - Definition, How It Works, Formula For example, recall that John paid $783.53 for a zero-coupon bond with a face value of $1,000, 5 years to maturity, and a 5% interest rate compounded annually. Assume that immediately after John purchased the bond, interest rates change from 5% to 10%. In such a scenario, what would be the price of the bond?

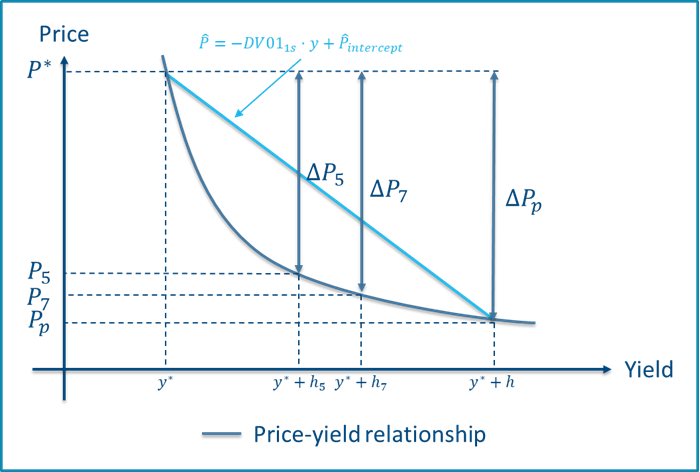

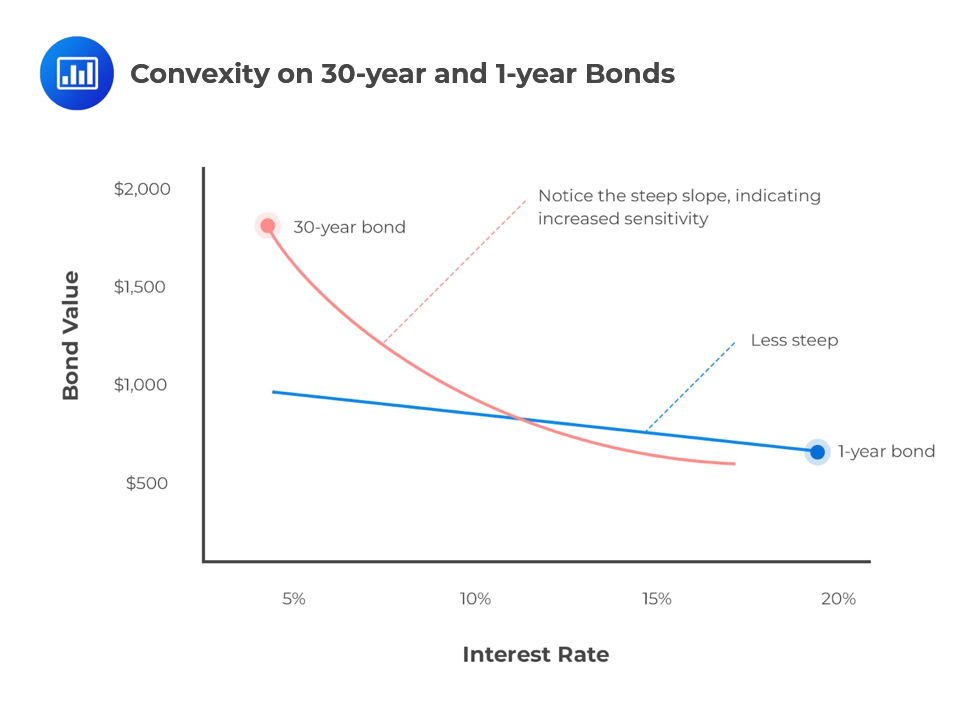

PDF Understanding Duration - BlackRock Duration can help predict the likely change in the price of a bond given achange in interest rates. As a general rule, for every 1% increase or decreasein interest rates, a bond's price will change approximately 1% in the oppositedirection for every year of duration. For example, if a bond has a duration of 5 years, and interest rates increase b...

What is the duration of a zero coupon bond

For zero coupon bonds? Explained by FAQ Blog A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. ... A coupon is a periodic interest received by a bondholder from the time of issuance of the bond till maturity. Zero coupon bonds, also known as discount bonds, do not pay any interest to the bondholders. What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. ... A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years.

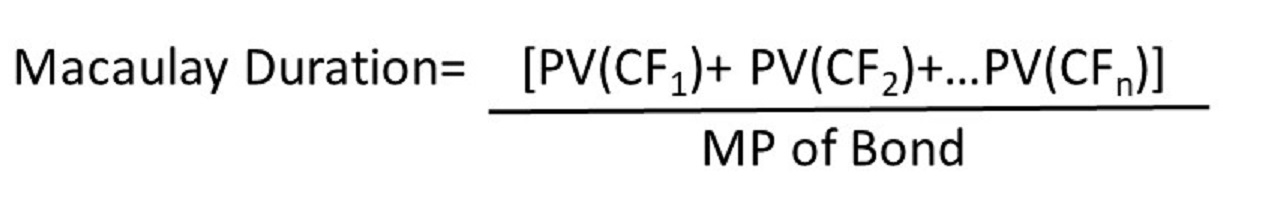

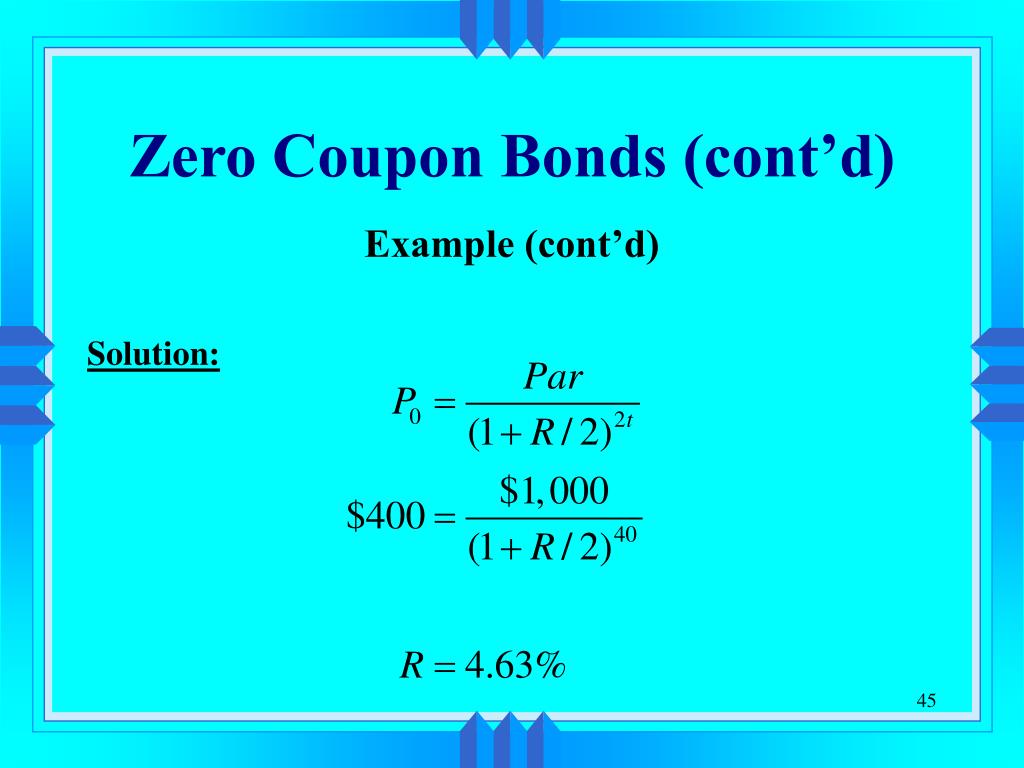

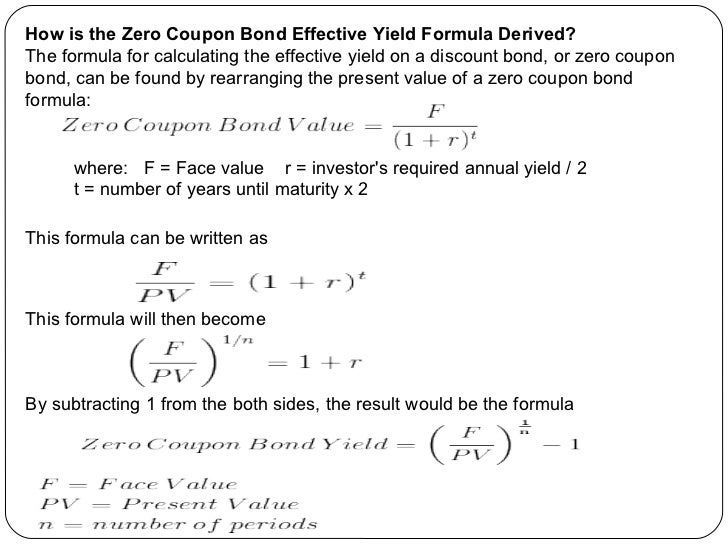

What is the duration of a zero coupon bond. Should I Invest in Zero Coupon Bonds? | The Motley Fool So for instance, a 10-year zero coupon bond priced when prevailing yields were 3% would typically get auctioned for roughly $750 per $1,000 in face value. The $250 difference would essentially... Zero-Coupon Bond Definition - Investopedia The maturity dates on zero-coupon bonds are usually long-term, with initial maturities of at least 10 years. These long-term maturity dates let investors plan for long-range goals, such as saving... Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. The Macaulay Duration of a Zero-Coupon Bond in Excel - Investopedia Macaulay duration is the weighted average time to maturity of the cash flows received from a bond. With a zero-coupon bond, the Macaulay duration is its time remaining until maturity. Macaulay...

What is the duration of a zero-coupon bond that has eight years ... - Quora Answer (1 of 5): Macaulay duration is the weighted average time to cash flow, weighted by the present value of the cash flow. A zero-coupon bond only has one cash flow, so the Macaulay duration is equal to the time to cash flow, 8 years and 10 years in your question. The modified duration is the... Advantages and Risks of Zero Coupon Treasury Bonds - Investopedia The responsiveness of bond prices to interest rate changes increases with the term to maturity and decreases with interest payments. Thus, the most responsive bond has a long time to maturity... Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%. If you are interested in a further discussion of the difference between Macaulay, modified and effective duration ...

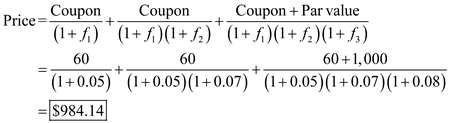

What Is Duration In Finance? - Investopedia The modified duration of a bond with semi-annual coupon payments can be found with the following formula: ModD=\frac {\text {Macaulay Duration}} {1+\left (\frac {YTM} {2}\right)} M odD = 1+( 2Y T... Solved a. What is the duration of a zero-coupon bond that | Chegg.com Finance questions and answers. a. What is the duration of a zero-coupon bond that has ten years to maturity? b. What is the duration if the maturity increases to 11 years? c. What is the duration if the maturity increases to 12 years? a. Duration of the bond Duration of the bond c. Duration of the bond years years years. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Instead interest is accrued throughout the bond's term & the bond is sold at a discount to par face value. After a user enters the annual rate of interest, the duration of the bond & the face value of the bond, this calculator figures out the current price associated with a specified face value of a zero-coupon bond. Dollar Duration - Overview, Bond Risks, and Formulas The formula for calculating duration is: Where: n = Years to maturity; c = Present value of coupon payments; t = Each year until maturity; The formula for calculating dollar duration is: Dollar Duration = DUR x (∆ i/1+ i) x P. Alternatively, if the change in the value of the bond and the yield is known, another formula can be used: DV01 ...

Duration and Convexity to Measure Bond Risk - Investopedia The duration of a zero-coupon bond equals time to maturity. Holding maturity constant, a bond's duration is lower when the coupon rate is higher, because of the impact of early higher coupon payments.

Zero-Coupon Bonds : What is Zero Coupon Bond? - Groww Suitable Tenure for Zero Bond Coupon. The time and the maturity value of Zero Coupon bonds share a negative correlation. The longer until the maturity date, the less the investors have to pay for it. Therefore, the Zero Coupon bonds generally come with a time horizon of 10 to 15 years. On the other hand, these bonds with a time period of less ...

Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. ... A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years.

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

For zero coupon bonds? Explained by FAQ Blog A zero-coupon bond doesn't pay periodic interest, but instead sells at a deep discount, paying its full face value at maturity. ... A coupon is a periodic interest received by a bondholder from the time of issuance of the bond till maturity. Zero coupon bonds, also known as discount bonds, do not pay any interest to the bondholders.

Post a Comment for "40 what is the duration of a zero coupon bond"